Project Headed by : Ashish Jain, Sutra Management Consultancies

Blog Presented by : Jimmy George, ByGeorge Content Solutions

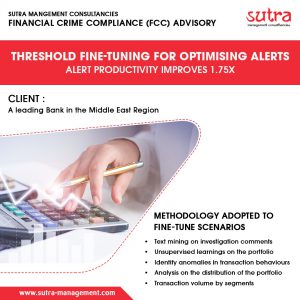

Sutra Management Consultancies incorporated threshold fine-tuning for optimising alerts from legacy scenarios, for one of the largest banks in UAE. Sutra Financial Crime Compliance (FCC) Advisory was required to address the challenge of enhancing the legacy system, to better handle investigation and improve productivity.

This alert optimisation feature developed by Sutra Financial Crime Compliance (FCC) Advisory uses an analytical model with threshold fine-tuning. It improved the productivity rate of alerts by as much as 1.75X times, and further reduced false positives by over 15% of the total alerts. These twin benefits positively impacted the efficacy and accuracy of the alert investigation.

Client : One of the largest banks in UAE

Task : Designing a new feature threshold fine-tuning

Approach : Quantitative basis of defining thresholds for newly defined scenarios

Solution : Alert optimisation & productivity enhancement

This article features a use-case of feature enhancement in the form of ‘Threshold Fine-tuning for Optimising Alerts’ for AML legacy scenarios, for a leading bank in the Gulf Region.

Client : A leading Bank in the Middle East Region

The client is one of the leading banks catering to enterprises and HNIs, based in UAE in the Middle East Region. The bank had instituted anti-money laundering solution based on a legacy system.

Business Challenge : High operational load and inaccuracy of alerts

Specifically, the bank was seeking ways and means to improve productivity of investigation team. The system was throwing up higher number of false positives in the alerts generated. This was leading to an increase in the non-identification of true positives. Together with the surge in number of alerts, this was leading to higher operational load on the investigation team.

Changing Business Scenario: New customer segments being added

This system had established judgmental thresholds for more than fifteen scenarios, in the individual and non-individual segments. Client recently introduced 20+ segments and intended to create segment specific scenarios. Client intended to reduce their false positive and maximize their actual high risk cases.

Sutra FCC Solution : Incorporating a state-of-the-art feature

A new feature of threshold finetuning based alert optimisation was recommended. This was found to be the best-fit approach to manage legacy scenarios, as well as to handle the new customer segments introduced.

Sutra FCC Advisory : Methodology adopted to fine-tune scenarios

The methodology instituted used systematic insight generation, followed by fine-tuning of the scenarios based on specific learnings.

A text mining was conducted on the investigation comments, mentioned by the investigators. This was followed by unsupervised learnings on the portfolio, to identify anomalies in transaction behaviours. Further analysis was done on the distribution of the portfolio, in terms of transaction volume by segments. Al these steps were duly conducted and corresponding insights generated were used to fine-tune scenarios and to build up cases.

The critical steps conducted in an orderly manner, enables a diligent approach leading to systematic insight generation – right from exploration, identification and segmented analysis, insight generation and prudent solutioning.

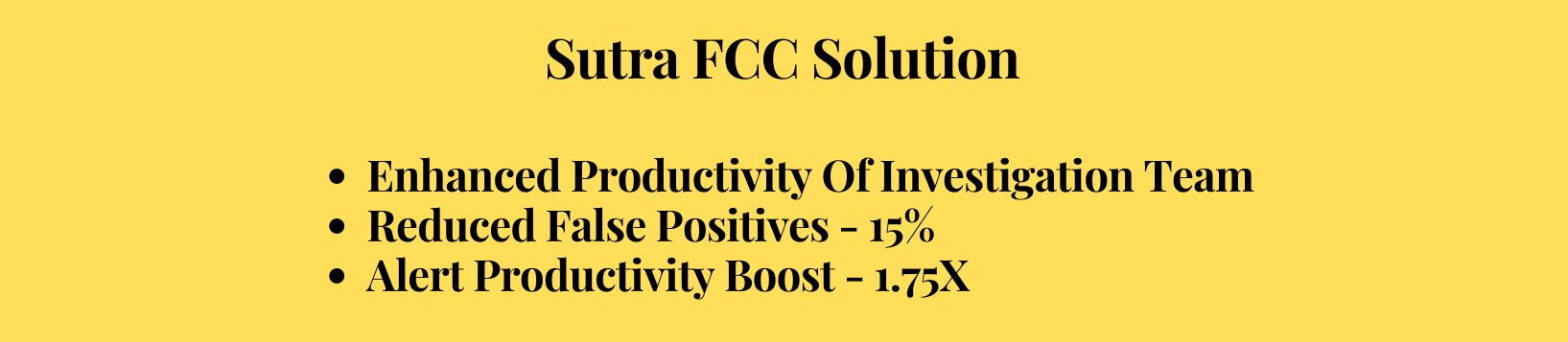

Business Results – Significant improvements in alert productivity & profiling accuracy

The engagement strived to improve the overall productive rate of alerts thereby improving effectiveness of the investigation staff. The improved and value-added feature not only reduced the number of alerts, but significantly improved the productivity rate of alerts. All this was achieved while reducing the threshold for individual segments, so as to better capture customer segments that do low ticket size transactions.

Sutra FCC Solution :

- The solution significantly improved the productivity rate of alerts.

- A quantitative basis of defining thresholds for newly defined scenarios was developed.

- Productivity rate of the alerts improved by 1.75X.

- Reduced false positives by over 15% of the total alerts.

To know about the Anti-Money Laundering projects delivered by Sutra Management Consultancies, read the blog –https://blog.sutra-management.com/?p=277

About Us

Sutra Management Consultancies is a group of business advisory firms offering advisory services into Analytics, Business strategy, Financial Crime Compliance and Big data. We use the power of analytics to improve profitability, processes, increase market share of business and make them comply with the regulations. Sutra Management now has 14 years of success serving more than 270+ clients globally and has regional offices in UAE, India and Indonesia.

To know about Sutra’s Financial Crime Compliance Advisory, visit https://www.sutra-management.com/fcc.html