Abhishek Gupta, Saurabh Assat & Indrani Biswas

“There is an increasing pressure on compliance professionals, and in order to break the treadmill cycle concept of how it is managed today, organisations are better off adopting Artificial Intelligence enabled compliance journeys and processes.

As an industry, we have to come up with effective methods and business processes, incorporating latest technologies and automation, to better manage financial crime compliance, anti-money laundering and financial frauds.”

Saurabh Assat,

Senior Project Manager,

Sutra Management Consultancies

Focus on Anti-Money Laundering (AML) compliance is gaining prominence given the rising incidences of financial crimes, and the innovative ways being used by money launderers to bypass existing checks.

At the same time, institutions have struggled with the efficiency and cost of existing processes, which involve high levels of manual and repetitive tasks.

The business challenge is to develop accurate, automated and low-cost technological solutions, that are risk prone in terms of their ability to weed the grain from the chaff.

Artificial Intelligence (AI) has been proclaimed as a game changer across disciplines, and Anti-Money Laundering (AML) is no exception. The debate around slow but gradual progress of AI in AML is wide open, with organisations at varying stages of adoption of AI tools and techniques to strengthen their AML programs.

This article highlights the value addition that AI can bring within the AML function, and the modelling of a compliance strategy with specific applications of AI in the sub-disciplines.

So what are the specific domain applications for Artificial Intelligence in Anti-Money Laundering

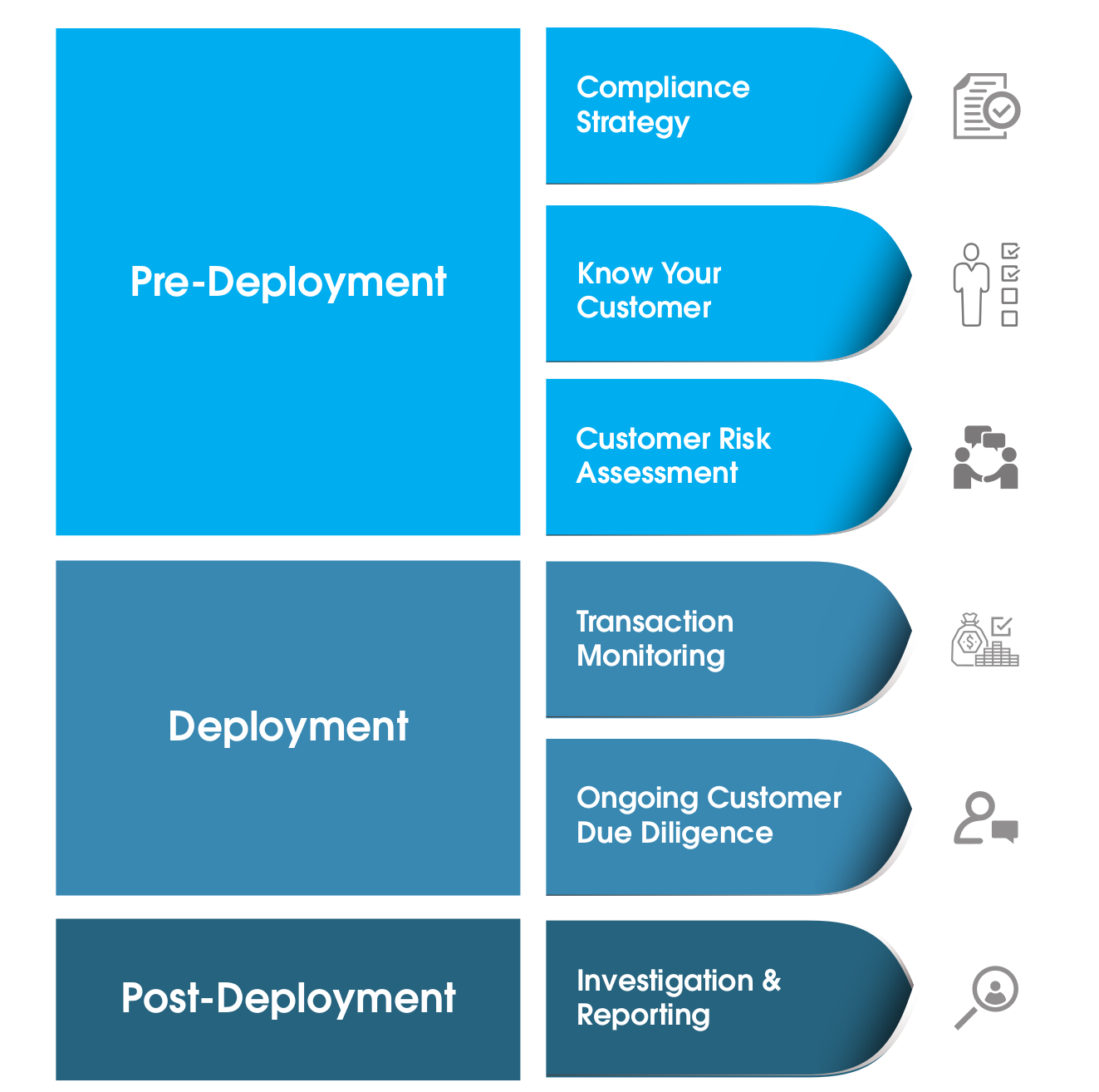

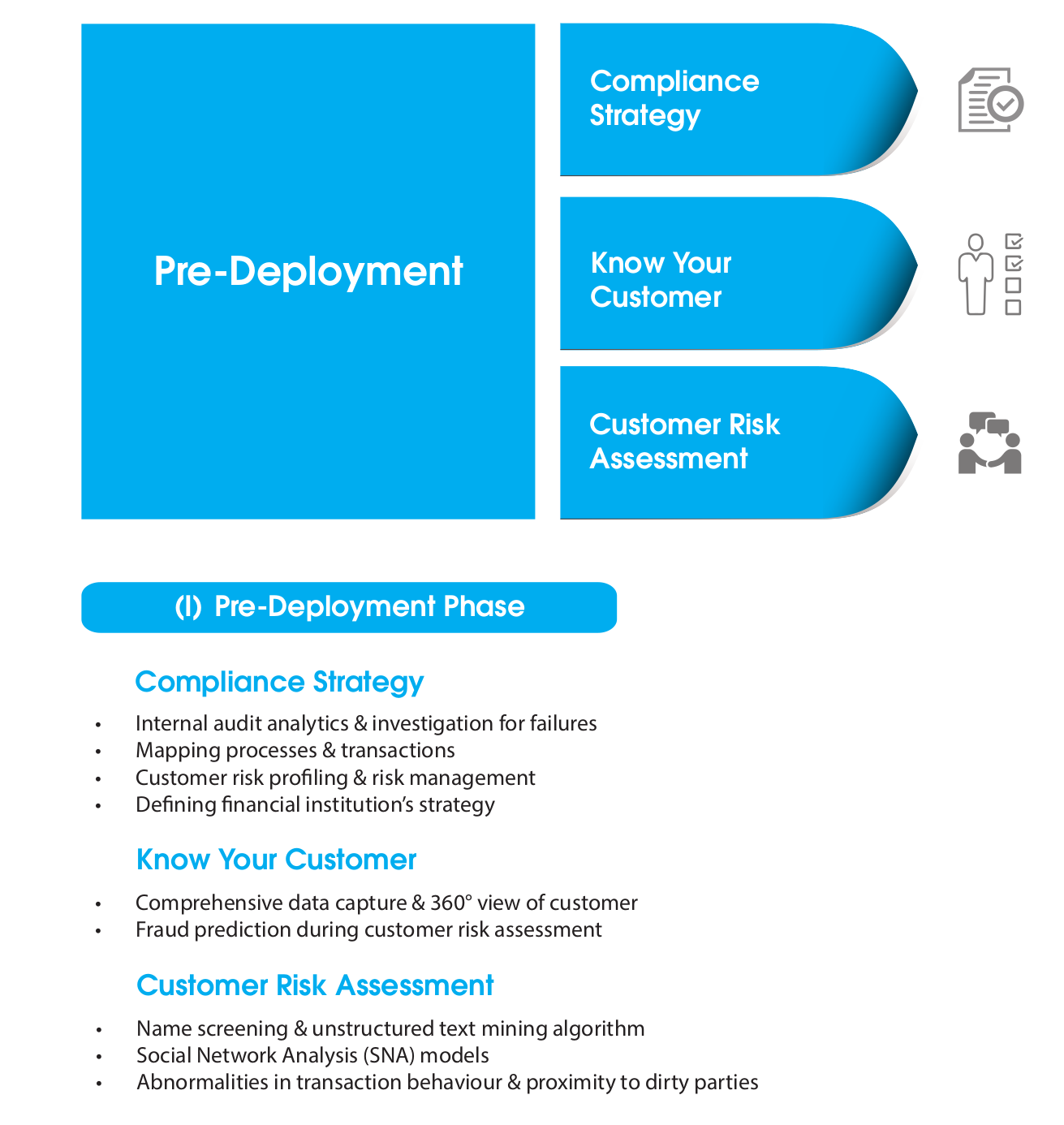

Artificial intelligence presents a world of opportunities across the business processes involving the compliance function; specifically in anti-money laundering and its sub-disciplines.

The specific sub-disciplines for widespread application consist of Know Your Customer, Customer Due Diligence and Enhanced Due Diligence, and Sanctions-Screening.

This is explained below through a step by step building of compliance strategy applying the functionalities of AI in specific domains and sub-domains.

Building a Compliance Strategy – Integrating AI Applications at each step makes for a futuristic solution:

(I) Pre-Deployment Phase

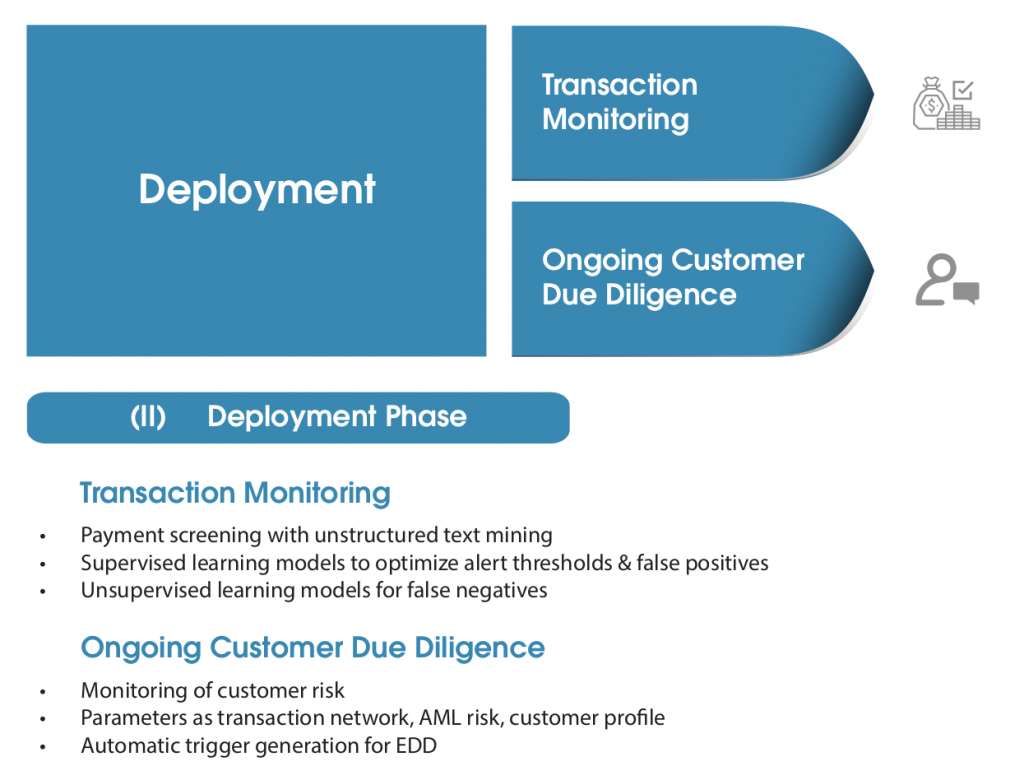

(II) Deployment Phase

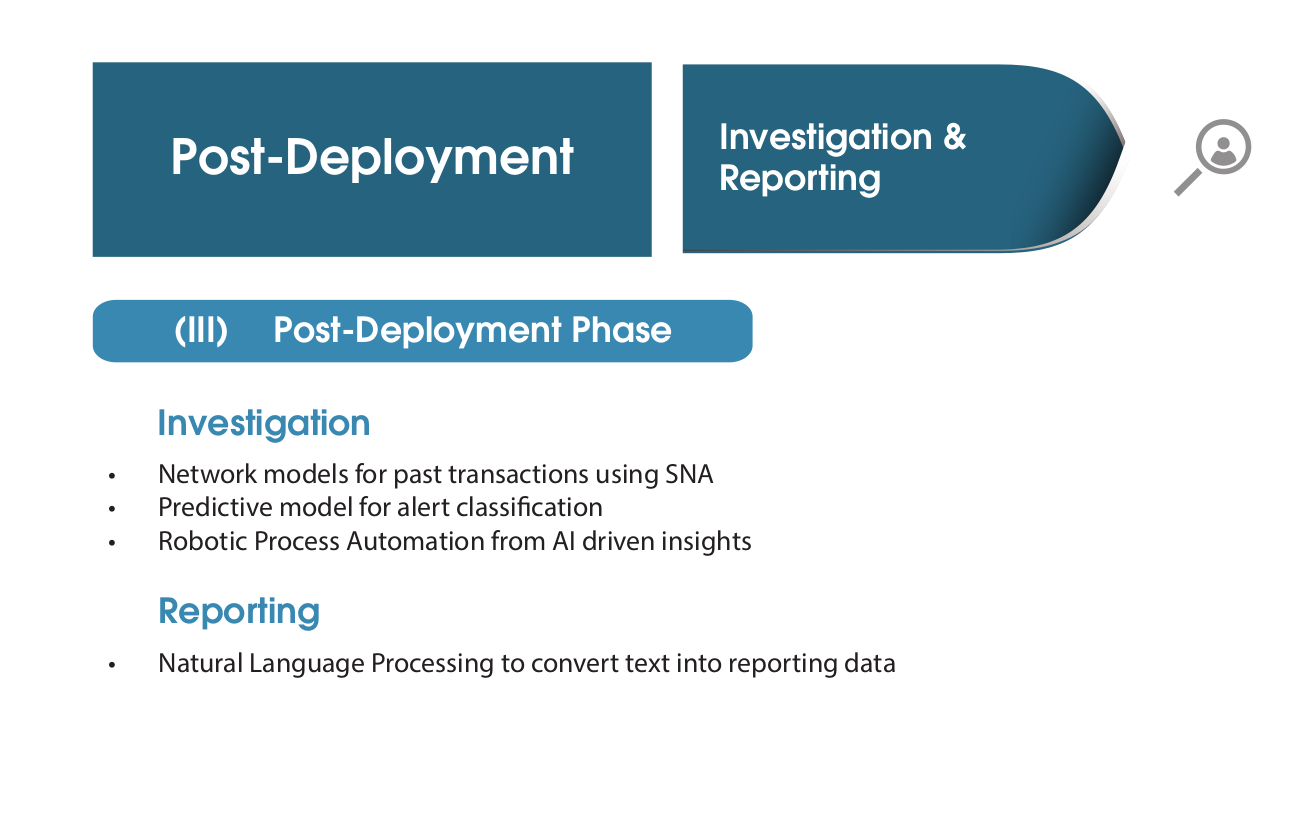

(III) Post-Deployment Phase

Growing adoption and stages of AI Application in AML

As we have seen above, AI presents many opportunities for making the AML programs more intelligent. However, organisations reside in different stages with respect to the adoption of AI.

Many factors affect the adoption, the principal ones being size and complexity of the organization in terms of type of operations, scale and spread of the business , and number of transactions. The regulatory environment and acceptance around usage of AI and the skillset availability plays an important role.

To know about the AI application stages, read the blog – Spectrum of AI adoption & application stages

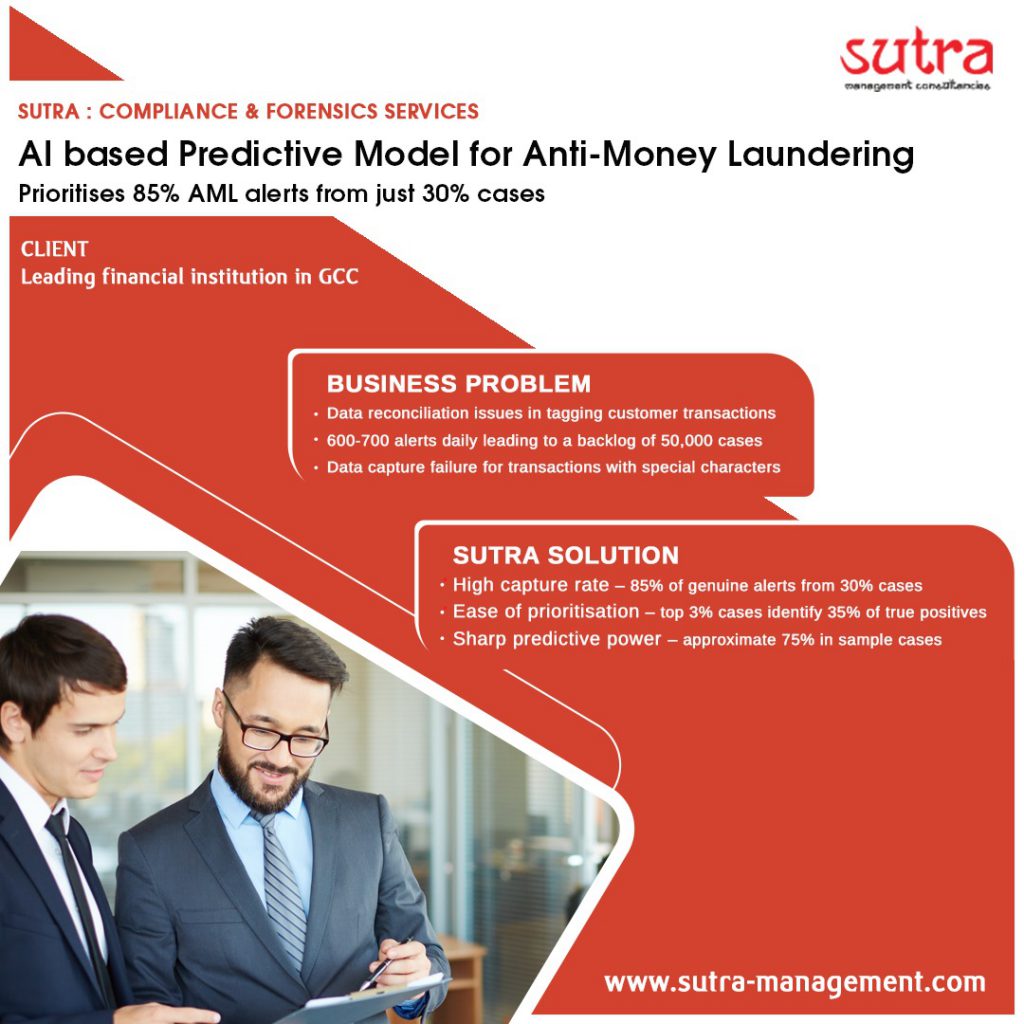

Use-Case : Implementation of a ‘Predictive Model’ in a Financial Institution improves investigation productivity.

Sutra Management Consultancies has successfully leveraged AI for AML, for use cases in financial domain.

The predictive model was developed for a financial institution based in GCC. This project used a model for reducing false positives, for bringing more efficiency to the investigation process.

The model was developed using logistic regression and predicts the probability of an alert. High performance was achieved through usage of multi-variate patterns and associations.

Sutra Solution: High predictive power was observed.The institution could capture 85% of genuine alerts by focusing on just 30 % of total alerts.

To read more, click on use-case of predictive power.

Increasing AI acceptance and adoption to enhance and transform business processes

Artificial intelligence is an evolving science which has multiple applications. Usage of AI tools and techniques is gradually gaining acceptance, though the final frontier remains unconquered due to many challenges, principal amongst which are data requirements, skill sets and acceptance amongst practitioners and regulators.

Institutions that are considering AI as a strategic priority will reap benefits in the long run as opposed to those who follow a tactical approach. A right combination of simple analytical tools, more advanced tools in ML, and understanding of the business and behavioural context is required to harness the true potential of AI.

Authors:

Abhishek Gupta

Abhishek Gupta

Managing Director

Abhishek Gupta is one of the founding members of Sutra Management Consultancies. He has over 18 years of experience in Business strategy, Corporate finance and Analytics. He has served over 50 clients in Banking and Financial Services, Telecom, Governments, FMCG, Retailing and more across the globe and had led several engagements on regulatory compliance and business strategy areas. Abhishek is a Mckinsey & Co. alumni and he is a founding member of Analytics Centre of Excellence at McKinsey.

e-mail: ab@sutra-management.com

Saurabh Assat

Saurabh Assat

Senior Project Manager

Saurabh Assat leads the analytics practice at Sutra. He has 9 years of cross-functional experience in analytics and business consulting. Saurabh has served some of the largest multi-national organisations across Middle East and South East Asia, especially in Banking and Financial Services, Telecommunications, Governments and Airlines. His work across more than 40 engagements, covers customer and marketing analytics, risk management and big data management.

e-mail: sa@sutra-management.com

Indrani Biswas

Indrani Biswas

Project Manager

Indrani has more than 12 years of experience in business consulting, implementation and project management. She has worked on multiple engagements across North America, Middle East and South East Asia in the areas of Anti Money Laundering, Fraud Management, business intelligence, data warehousing and building analytical reporting framework.e-mail: ib@sutra-management.com

About Us

Sutra Management Consultancies is a group of business advisory firms offering advisory services into Analytics, Business strategy, Financial Crime Compliance and Big data. We use the power of analytics to improve profitability, processes, increase market share of business and make them comply with the regulations. Sutra Management now has 14 years of success serving more than 270+ clients globally and has regional offices in UAE, India and Indonesia.